Optimise Your Capital Allocation by Harnessing our Trade Finance Solutions

The purpose of our trade finance product is to make it easier for businesses to transact with each other.

We facilitate trade and protect both buyers and sellers from trade-related risks.

Obtain more information

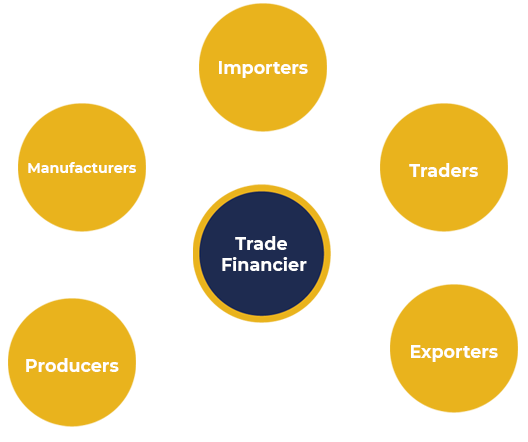

Who Needs Trade Finance?

Benefits of trade finance

- Closing the working capital gap

- Mitigates the risk inherent in certain trade transactions, such as the risk of non-payment

- An enabler to sellers to access the short-term finance they need to secure orders

- It plays an important role in facilitating international trade

- Improves cash flow and optimizes capital allocation

- Enables better management of trade receivables

Product Offering

- Cash advance

- Domestic order finance

- Working capital limits

- Import finance

- Pre-shipment export finance

- Invoice financing

- Trade insurance